How to Build a Cryptocurrency Portfolio for 2025

In 2024, the cryptocurrency market continued its dynamic development, offering more opportunities for those ready to invest their funds. Even in the U.S., where financial activities are conservatively regulated, cryptocurrency-focused funds were introduced in 2024. According to CoinShares, these funds experience more frequent asset inflows than outflows.

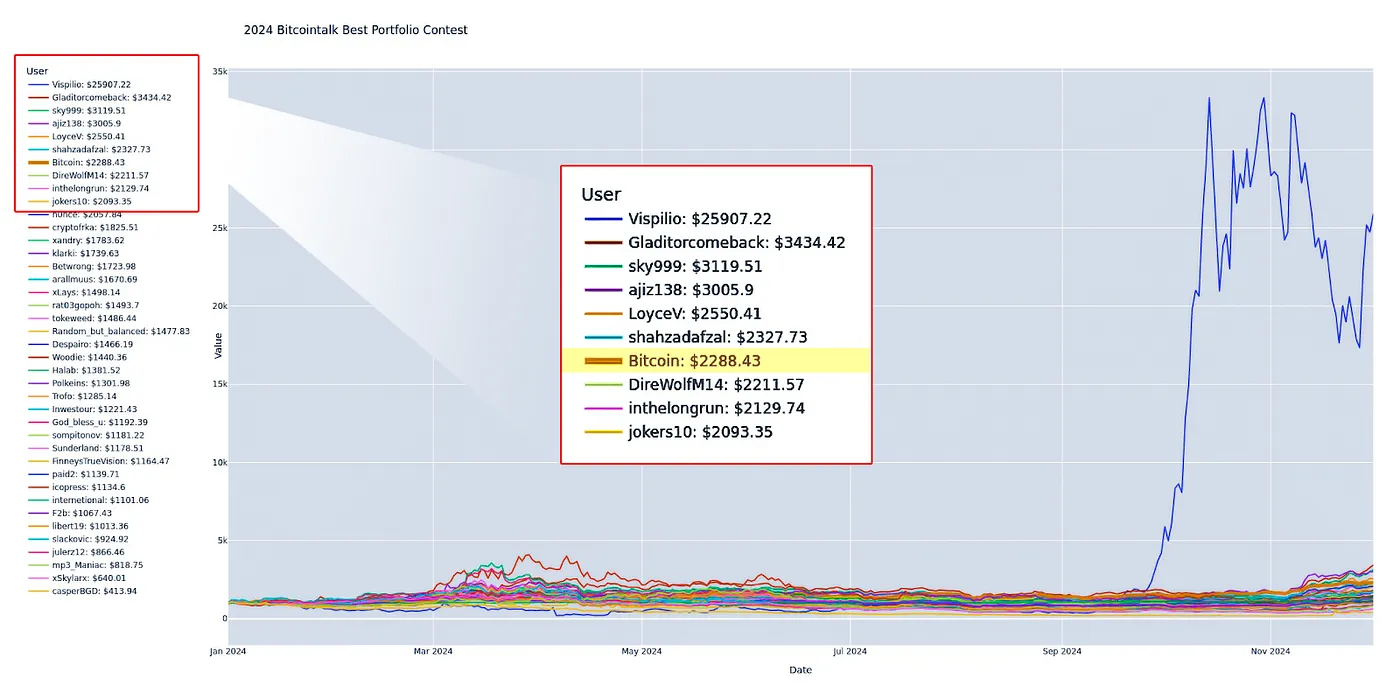

The end of 2024 will undoubtedly be remembered as a time when many cryptocurrencies experienced significant price increases. However, not all of them did. Some assets surged at astonishing rates, while others stagnated or even declined. Although the year is not over yet, I can’t see any signs that market dynamics will change, with selective price growth continuing rather than transitioning to universal growth.

In such a market, everyone likely wants to find assets that will either help grow their capital in 2025 or at least protect it from the inflation of fiat currencies. However, the task of building a portfolio for the year is very challenging.

Choosing Assets for a Cryptocurrency Portfolio

When purchasing cryptocurrencies for investment rather than for use, the most critical question to ask yourself is: Who will buy this asset from me later?

Not all cryptocurrencies are liquid. However, there are some assets that can be added to a portfolio without fear of being stuck with them indefinitely:

Bitcoin (BTC)

Bitcoin is the only cryptocurrency whose exchange for dollars at market rates is guaranteed by a state (El Salvador). However, this factor is unlikely to be decisive for most Bitcoin buyers. Bitcoin’s demand stems from its reliability as a storage of value, secured within the blockchain, where assets cannot be confiscated or frozen. The blockchain’s security is underpinned by an unprecedented level of computational power provided by miners and users verifying blocks.

Cryptocurrencies for Blockchain Fees

Some cryptocurrencies are essential for transaction fees in widely-used blockchains:

- Ethereum (ETH): The asset for paying decentralized applications (dApps) and smart contracts in both Ethereum’s main network and some Layer 2 solutions like Base. As long as dApps and smart contracts remain in demand, ETH will retain value and be sellable.

- Tron (TRX): Many users rely on the Tron blockchain for transferring the most popular stablecoin, USDT, and each transfer requires TRX.

Cryptocurrencies Valued by Developers

These assets play a crucial role in blockchain innovation:

- Solana (SOL): Known as the leading platform for launching meme tokens, Solana powers tools like pump.fun, which require SOL tokens. Developers launching meme tokens in large communities need SOL.

- Polkadot (DOT): A network of interconnected blockchains, Polkadot validates and stores data for each connected chain. New crypto projects that cannot independently maintain a blockchain can integrate into Polkadot for added security and stability.

[...truncated for brevity...]